Overview

Business models are based on providing products or services that are profitable now, but they also attempt to identify changes in offerings that will keep the company profitable in the future. The current moneymakers are easy to identify now, but a good business strategy also asks, "What about the future?"

Created by the Boston Consulting Group, the BCG matrix – also known as the Boston or growth share matrix – provides a strategy for analyzing products according to growth and relative market share. The BCG model has been used since 1968 to help companies gain insights on what products best help them capitalize on market share growth opportunities and give them a competitive advantage.

Reeves Martin, senior partner and managing director of the Boston Consulting Group, said that nearly 50 years after its inception, the BCG matrix model remains a valuable tool for helping companies understand their potential.

Creating your matrix

To analyze your own company, first, you'll need data on the relative market share and growth rate of your products or services.

When examining market growth, you need to objectively determine your competitive advantage over your largest competitor and think in terms of growth over the next three years. If your market is extremely fragmented, however, you can use absolute market share instead.

Next, you can either draw a BCG matrix or find a BCG matrix template program online. There are several that are free, available for subscription or are part of another charting program, such as the free one by Miro.

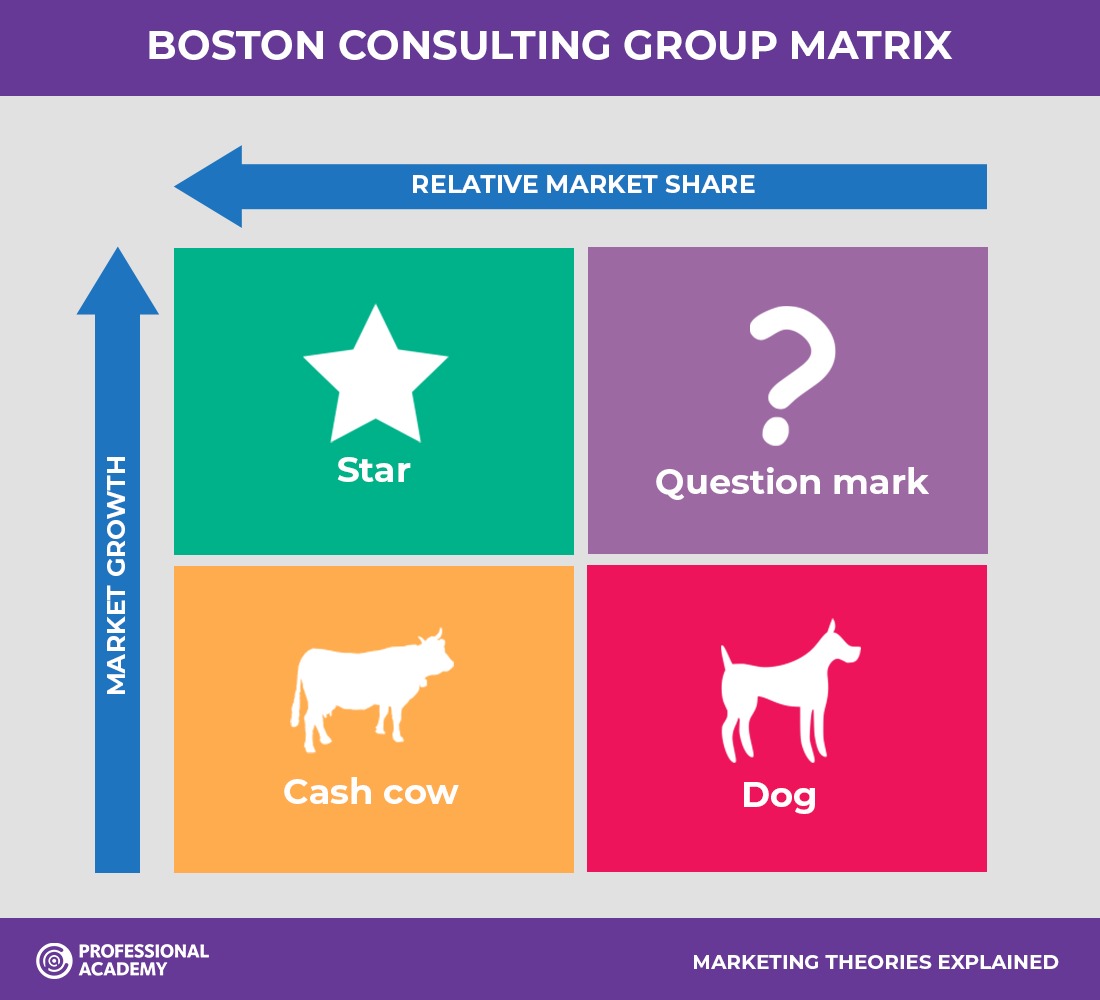

In this four-quadrant BCG matrix template, market share is shown on the horizontal line (low left, high right) and growth rate is found along the vertical line (low bottom, high top). The four quadrants are designated Stars (upper left), Question Marks (upper right), Cash Cows (lower left) and Dogs (lower right).

Place each of your products in the appropriate box based on where they rank in market share and growth. Where you choose to set the dividing line between each quadrant depends in part on how your company compares to the competition.

Here is a breakdown of each BCG matrix quadrant:

- Stars: The business units or products that have the best market share and generate the most cash are considered stars. Monopolies and first-to-market products are frequently termed stars. However, because of their high growth rate, stars consume large amounts of cash. This generally results in the same amount of money coming in that is going out. Stars can eventually become cash cows if they sustain their success until a time when a high growth market slows down. A key tenet of BCG strategy for growth is for companies to invest in stars.

- Cash Cows: A cash cow is a market leader that generates more cash than it consumes. Cash cows are business units or products that have a high market share but low growth prospects. According to NetMBA, cash cows provide the cash required to turn a question mark into a market leader, cover the administrative costs of the company, fund research and development, service the corporate debt, and pay dividends to shareholders. Companies are advised to invest in cash cows to maintain the current level of productivity or to "milk" the gains passively.

- Dogs: Dogs, or pets as they are sometimes referred to, are units or products that have both a low market share and a low growth rate. They frequently break even, neither earning nor consuming a great deal of cash. Dogs are generally considered cash traps because businesses have money tied up in them, even though they are bringing back basically nothing in return. These business units are prime candidates for divestiture.

- Question Marks: These parts of a business have high growth prospects but a low market share. They consume a lot of cash but bring little in return. In the end, question marks lose money. However, since these business units are growing rapidly, they have the potential to turn into stars in a high growth market. Companies are advised to invest in question marks if the product has the potential for growth, or to sell if it does not.

Using the BCG matrix to strategize

Now that you know where each business unit or product stands, you can evaluate them objectively.

In an article on Marketing 91, author Hitesh Bhasin outlines four potential strategies you can follow based on the results of your BCG matrix analysis:

- Increase investment in a product to increase its market share. For example, you can push a question mark into a star and, finally, a cash cow.

- If you can't invest more into a product, hold it in the same quadrant, and leave it be.

- Reduce your investment and try to take out the maximum cash flow from the product, which increases its overall profitability (best for cash cows).

- Release the amount of money already stuck in the business (best for dogs).

You need products in every quadrant of your BGC matrix to keep a healthy cash flow and have products that can secure your future.

BCG MATRIX 2.0 IN PRACTICE

To get the most out of the matrix for successful experimentation in the modern business environment, companies need to focus on four practical imperatives:

Accelerate. It is critical to evaluate the portfolio frequently. Businesses should increase their strategic clock-speed to match that of the environment, with shorter planning cycles and feedback loops requiring simplified approval processes for investment and divestment decisions.

Balance exploration and exploitation. This requires having an adequate number of question marks while simultaneously maximizing the benefits of both cows and pets:

- Increase the number of question marks. This requires a culture that encourages risk taking, tolerates failure, and allows challenges to the status quo.

- Test question marks quickly and economically. Successful experimenters achieve this by using rapid (for example, virtual) tests that limit the cost of failure.

- Milk cows efficiently. Successful companies do not neglect the need to exploit existing sources of advantage. They milk low-growth businesses by improving profitability through incremental innovation and streamlining of operations.

- Keep pets on a short leash. With experimentation comes failure: our analysis found that the number of pets increased by almost 50 percent in 30 years. Although Bruce Henderson asserted that pets were worthless, today’s successful companies capture failure signals from pets to inform future decisions on where and how to experiment. Additionally, they attempt to lower exit barriers and move quickly to squeeze out remaining value before divestment.

Select rigorously. Companies must carefully select investments as well as divestments. Successful companies leverage a wide range of data sources and develop predictive analytics to determine which question marks should be scaled up through increased investment and which pets and cows to divest proactively.

Measure and manage portfolio economics of experimentation. Understanding the experimentation level required to maintain growth is important for long-term sustainability:

- Manage the rate of experimentation. Successful companies continually measure and manage the number and costs of the question marks they generate to ensure their pipeline stays filled.

- Drive new product and business success. Companies need to ensure that the probability that question marks become stars is high enough—and that the cost of failure for these question marks is acceptable—in order to sustain growth from new products.

- Maintain a portfolio balance. Successful companies look for today’s stars (and question marks) to ultimately generate at least enough profitability to replace cows (and pets) that are later in their life cycle so that the company portfolio generates sufficient profitability in the long run.

Increasing change certainly requires companies to adjust how they apply the matrix. But it does not undercut the power of the original concept. What Bruce Henderson wrote years ago still holds today, perhaps even more so than ever: “The need for a portfolio of businesses becomes obvious. Every company needs products in which to invest cash. Every company needs products that generate cash. And every product should eventually be a cash generator; otherwise it is worthless. Only a diversified company with a balanced portfolio can use its strengths to truly capitalize on its growth opportunities.”