What is QuickBooks?

QuickBooks is a robust accounting solution that enables businesses to lessen the effort and time they put into routine accounting tasks. Integrated tools help with drafting invoices, reconciling bank records, monitoring financial reports and tracking expenses. In addition, it allows users to import data from third-party apps, such as American Express, Square and PayPal, making it convenient to record and categorize all incoming and outgoing transactions.

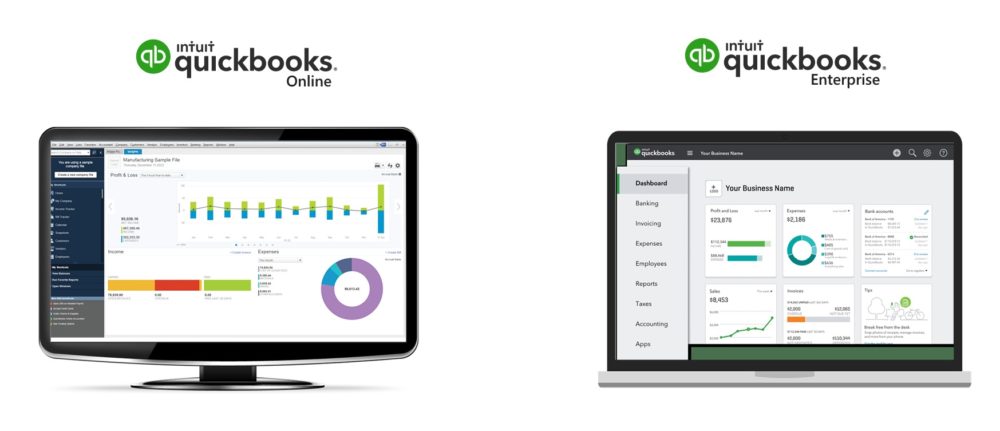

QuickBooks offers both an online and on-premise version of its software.

QuickBooks Online lists four plans for self-employed consultants and companies: Self-Employed, Simple Start, Essentials and Plus. Each plan allows users to accept payments, send invoices, run reports and track income, expenses and miles.

In contrast, the on-premise version – QuickBooks Desktop – lists three plans: Pro, Premier and Enterprise. These desktop plans offer similar features to the cloud-based version of QuickBooks, plus add-on features like 24/7 support, upgrades and data backups (with each add-on requiring a separate fee payment).

QuickBooks Online Main Features Overview

QuickBooks Online

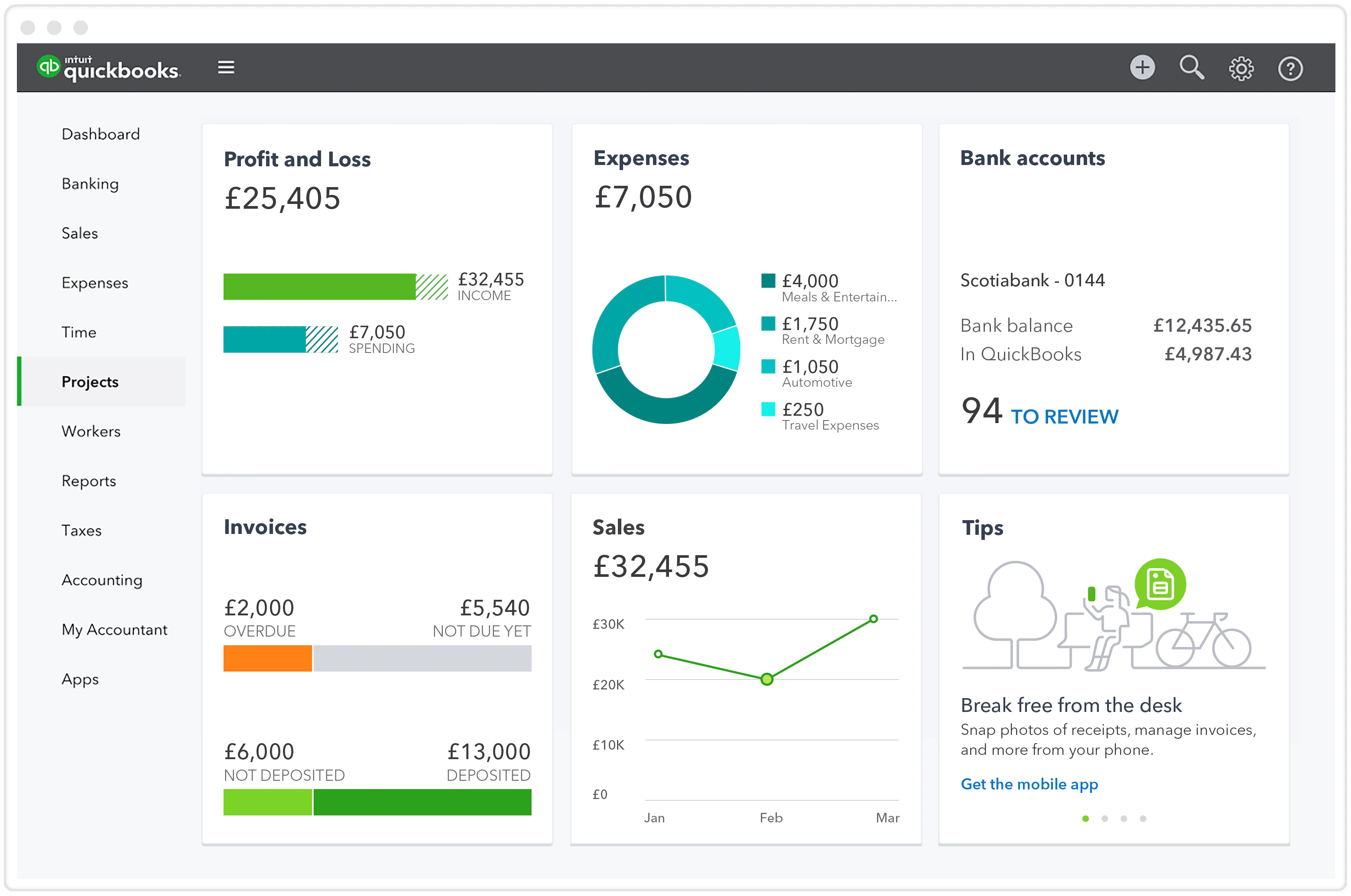

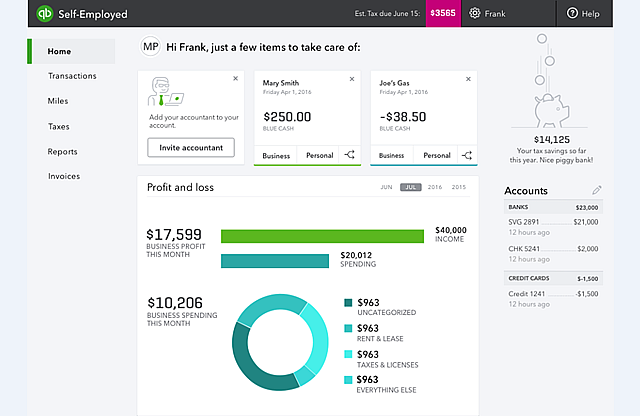

QuickBooks Online features vary from plan to plan, with many of the deluxe features reserved for the higher-priced plans. However, all versions of QuickBooks Online offer the ability to track income and expenses, manage receipts, invoice and accept payments, track sales tax, and run reports. Like its competitors, QuickBooks Online skips the accounting lingo to use everyday language in its software.

QuickBooks allows you to connect all of your bank accounts to the software, where it will import and match transactions automatically, leaving you with a list of transactions that were unable to be matched. One of the most useful features is the My Accountant option, where you can invite your current accountant or CPA to use the program, and they will be given admin access to the program. An offer to link up with an accounting pro is also available if you want to utilize it.

QuickBooks Banking

The Banking feature is where you can manage all of the financial institutions that you connected to QuickBooks Online, with an overview of each account available. You can also connect additional accounts at any time. Rules can be assigned to particular accounts to reduce the amount of data entry needed, so you can create a rule named Fuel and set the expense category to Automobile Expense, eliminating the need to categorize the expense. A new Receipts category lets you register your email with QuickBooks Online, allowing you to snap a photo of a receipt while you're out and upload that receipt to QuickBooks Online for easy expense matching.

QuickBooks Expenses

The Expenses feature is where you manage all of your vendors and enter any bills that need to be paid. You can also print checks from this screen, and sort expenses by date, by status, or by vendor.

Any expenses that are imported from your financial institutions will also be listed in the expense transactions, including any bills that are entered, which makes it super easy to keep track of not only what's been paid from your bank account, but what bills still need to be paid. You can choose to pay outstanding bills via credit card and enter the expense or print a check to be mailed. All vendor information is also managed from the Expenses screen.

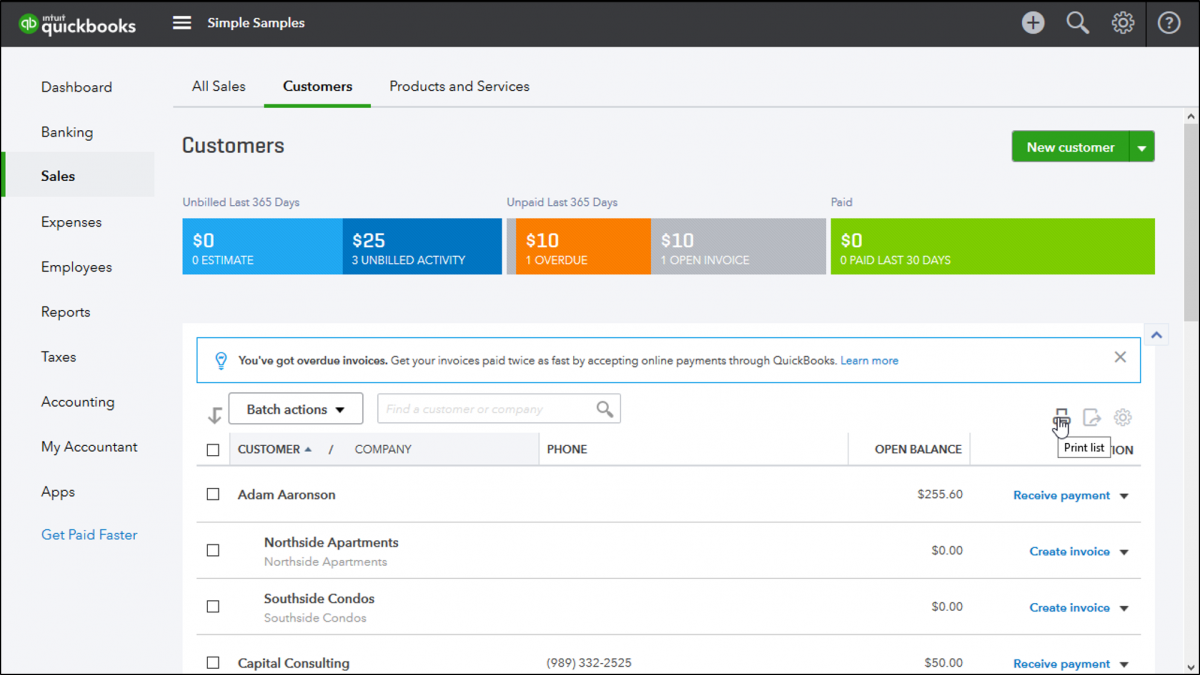

QuickBooks Sales

The Sales feature is where you can keep track of your customers, create a new invoice, and post payments. The invoices list provides you with a nice overview of all invoices that have been posted, as well as their current status. For any open invoice, you can send a reminder that the payment is past due, or email the customer a link to the invoice with an option to pay online. All customer information is managed from the Sales screen.

You can also manage your products and services from the Sales screen, including establishing a reorder point for your inventory items to eliminate pesky backorders. If you sell services but not inventory, you can keep track of those in this area as well.

QuickBooks Workers

Another thing I love in QuickBooks Online is the ability to track both employees and contractors, making it a breeze to prepare those 1099s at year’s end. The Workers screen lets you track information on all of your employees, but you'll have to add either Self-Service Payroll or Full Service Payroll from Intuit to pay your employees.

QuickBooks Reports

QuickBooks Online offers a good selection of standard reports, which are categorized as follows:

- Favorites

- Business overview

- Who owes you

- Sales and customers

- What you owe

- Expenses and vendors

- Sales tax

- Employees

- For my accountant

All reports can be customized and saved for future access once the report is run, and you can choose to email it directly to recipients, print it, or export it to Microsoft Excel or as a PDF.

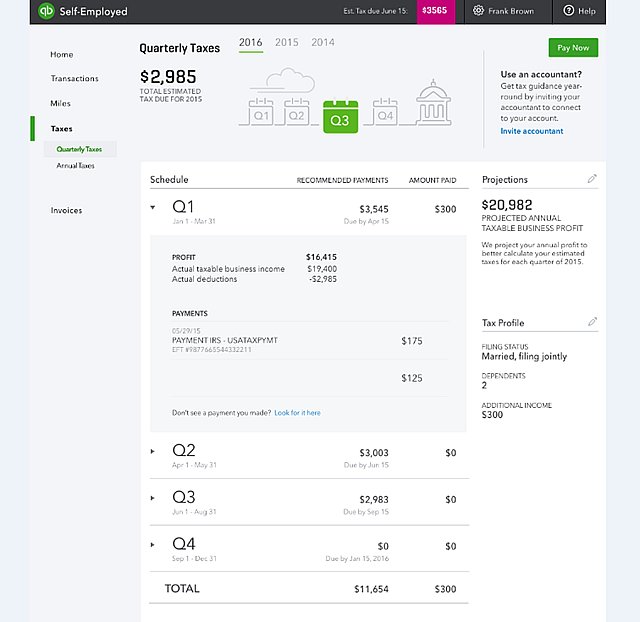

QuickBooks Taxes

The Sales Tax Center in QuickBooks Online lets you track the appropriate sales tax amounts for all purchases made. The Sales Tax Owed option tracks all relevant sales along with taxable sales, and the amount of tax assessed. It also tracks any payments made and the amount due. You can add as many sales tax rates as necessary, and can also add a new tax rate when creating a new invoice.

QuickBooks Accounting

The Accounting screen is where you can manage your chart of accounts details as well as reconcile your bank and credit card statements. QuickBooks Online currently includes up to 250 accounts in their standard plans, but if you have more than 250 accounts, you'll have to upgrade to their Advanced plan. You can view a register for any of the accounts that are active in your chart of accounts or make an unused account inactive.

The Reconcile feature makes the bank reconciliation process quick and relatively painless by opening the current bank statement, then matching the statement to your current general ledger (G/L) entries. Anything that remains unmatched will be identified to help ensure that the books remain in balance.

Mentioned earlier, QuickBooks Online includes solid import and export capability, so you can import a variety of data or export reports as needed. Like Xero, QuickBooks Online keeps its Budget feature well hidden, but you can access it under Tools, where you can create a budget for up to five years in monthly, quarterly, or yearly intervals. QuickBooks Online also offers multi-currency capability, and though you can only use one currency as your home currency, you can assign a foreign currency to customers, vendors, or financial institutions.

QuickBooks Support

QuickBooks Online offers numerous learning and support resources including a variety of articles that cover topics that range from product setup to bank feeds. Video tutorials are also available, as are webinars and various training classes. The QuickBooks Online Community is an area where you can connect with other users, ask questions, complain, and maybe even answer a question from another user. You can also access product support directly from QuickBooks Online, where you can ask a question or connect to a support expert.

QuickBooks Benefits

If QuickBooks is traditionally believed to streamline accounting, than QuickBooks Pro is supposed to polish and perfect the process. There are two products available: QuickBooks Pro and QuickBooks Pro Plus, both full of advanced functions and insights. The Desktop Pro version simplifies accounting and helps companies stay organized despite of the large amount of data they have to collect and analyze.

QuickBooks Pro nevertheless retains the core appearance and functionality users love so much, which once again praises the successful attempt of Intuit to remain the accounting leader of today’s business software market. The navigational efficiency is intact, the same as the loveable layout that transforms boring bookkeeping and multiple form management into an enjoyable experience.

All bills and overdue items are gathered in a single location to follow their progress with the Bill Tracker. There, you can also keep all of your accounting notes, and export information easily for all types of reporting. Another thing that is made really easy is online payment, as there is a single ‘Pay Now’ link which connects invoiced to credit cards and bank accounts. The Desktop Pro Plus will bring even more benefits, in particularly such related to security and safeguarding, 24/7 experienced and premium support, and convenient and timely upgrading. As such, QuickBooks Pro is the right choice for independent contractors, small, medium, and large online retailers, non-profit organizations, or professional and field service providers.

The most distinctive benefit of this system given its predecessors is automated reporting: unlike previous editions, the new QuickBooks Pro will allow users to customize reports the way they want them, and schedule them in an organized calendar skipping problematic delays and missed deadlines. All reports in the system are enabled with smart reporting filters that can be used multiple times to capture even the tiniest, yet relevant payroll item details. On top of that, the product features a variety of smart searching filters which speed up browsing in a personalized and auto complete manner. Overall, three users can obtain an admin role in the system, and modify the data that will be inserted there. Note that QuickBooks offers another product with the same features, which can be used by 5 users instead of three. The name of this advanced platform is QuickBooks Premier.

QuickBooks Pro will allow you to efficiently save transactions for every item that has previously been imported to the inventory asset database. Whenever something goes wrong, the system will report it through a direct warning message on the screen, and you will be invited to solve it by unlocking your advanced Accountant Toolbox, or contact their responsive technical support team for assistance. All issues can be imported easily even from Excel sheets, and changed easily to retain balance.

The Shipping manager, on the other hand, will reveal a whole dropdown list of packaging options, including the flat rate ones you often missed with your old accounting system. Once an account/item is verified, it enters the database from where you can easily export it for reports and further modifications. Speaking of verification, you may be interested to know that the new QuickBooks Pro is equipped with a Rebuilt Verification feature which displays even former verification, fixed and unfixed errors and their KBs. In this aspect, the system relies significantly on its numerous third-party integrations.

Finally, let’s take a look on security matters. As we already mentioned, QuickBooks Pro reinvents the concept of protecting accounting data, and does so with a number of security updates. For instance, you can activate the ‘Remember me’ option, modify safety preferences, and login only after 90 days of continuous using of this system. The admin decides whether this option will be visible or hidden for other users. However, he won’t have this option for the Credit Card Protection feature or the Personally Identifiable Information. The system even allows you to backup the content of your own database.

QuickBooks Pros Review

- Easy to use: QuickBooks is simple to use even for those who don’t have a degree in accounting, at least if your business’s account is simple.

- Good out-of-the-box reports: The standard reports QuickBooks uses are great for many small businesses.

- Connects to your business account: If you’re keeping all your business’s money in one place, as you should be, then you can connect QuickBooks to that account and track your income and expenses seamlessly. It’s just a matter of tagging your transactions as they pass through, and you’re good to go.

- Allows for additional applications: QuickBooks connects well with apps that you might use for other parts of your business, which just keeps things easier to use.

- Affordable: For what it is, QuickBooks really doesn’t cost much money. You can get a streamlined version of the app for as little as $10 per month.

- Invoicing and payment features: You can send invoices that look nice directly from QuickBooks. And you can allow your customers to pay you through the app, too, which eliminates the need to deal with paper checks.

QuickBooks Cons Review

- May not be complex enough: If your business is more complicated, QuickBooks may not be the best option for you. It doesn’t offer lots of customization on reporting, and it doesn’t have some industry-specific features like lot tracking.

- No direct professional support: You can use QuickBooks without an accountant to a point, but once your business gets more complicated, you may need a real bookkeeper.

- Limited number of users: You can’t let an unlimited number of people log into QuickBooks, which could be a problem if your business grows and has multiple departments.

What plans does QuickBooks Online offer?

QuickBooks Online Pricing and Discount with Promo, Coupon code

For the small business customer, Intuit has three different tiers of QuickBooks Online access. You can upgrade your plan at any time, but unfortunately can’t downgrade or return to a lower plan. This means it may be best to err on the side of choosing a lower plan to start off with, if you want to avoid spending more of your business’s dollars than necessary.

QuickBooks Simple Start ($ 15/month)

For the smallest or newest of businesses, this plan covers the basics without taking a massive chunk out of your budget.

- Track income, expenses, and profits

- Access over 20 built-in business reports

- 1 user at a time

QuickBooks Essentials ($ 25/month)

As your business grows, so too will your accounting needs. QuickBooks Essentials includes all of the functions from the Simple Start plan, plus:

- Manage and schedule bill payments

- Handle and convert multiple currencies

- Create remittance advices and expense receipts

- Control what your users can access

- Set up a recurring invoicing schedule

- Compare your sales and profitability with industry trends

- Up to 3 users at a time

QuickBooks Plus ($ 35/month)

For well-established small businesses with more complex accounting needs, the QuickBooks Plus plan adds more specialised features such as billable hours tracking and more detailed records tracking and categorisation. Plus includes all of the features from the Simple Start and Essentials plans, as well as:

- Create and send purchase orders

- Track inventory

- Categorise your income and expenses using class tracking

- Create budgets to estimate future income and expenses

- Give employees and subcontractors limited access, to enter time worked

- Track billable hours by customer

- Track sales and profitability for each of your locations

- Up to 5 users at a time

Now, we want to share with you about some reviews from member who used QuickBooks

- I teach Quickbooks for an Adult Education Organization in New York. They switched all their classes over to QB Online two year ago, mainly based on consumer demand. I would say that QBD will still be in effect until 2025, but you'll see an incremental reduction in new features each year, as the revenue from that particular division continues to diminish.

- On an Enterprise level, it'll probably stick around longer. Mainframe computers are still operating! But again, a slow curve downward. The only variable here is security, which is now finally becoming an issue that organizations focus upon. This might allow QBD to rebrand. Maybe a hybrid model, where more features are offline than QBO.

- I much prefer the desktop version, and the lack of features in the online version is striking. It's nice to not have to install software and share data with clients easily, but that's the extent of the benefits I've seen with the online version. In essence, both versions of QuickBooks serve different needs, and as long as both continue being profitable for Intuit, they can coexist.

- Quickbooks had a major overhaul of their database structure in - I want to say 2013. So yes, making the jump from 2003 to 2020 would give you all kinds of headaches. I don't think any more huge changes happened after that - which explains why you could go from 2012 to 2020. Honestly, I wouldn't make any jumps more than 3-4 years at one time as u/a679591 stated.

- Quickbooks is advertising their brand but that's a good thing imho because it transmits credibility. I have clients who are very cautious to open emails, much less make online payments. When they see that it's through Quickbooks and they recognize the company brand, it's reassuring.

- The Mac version is not the same as the PC version. The Mac version is lacking many features - you might as well use QB Online. Speaking from the experience here, what you should do is buy the “Parallels” software for Mac that will allow you to install Windows on your Mac and then run the good PC version of QB in this manner on your Mac. I’ve been doing it this way forever and it works flawlessly. Actually better than on a PC / PC’s suck in my opinion. Currently running QB Premier 2019 on a MacBook Air using Parallels, runs prefect - zero issues!

- QuickBooks Online utilizes Yodlee, which is just an aggregate to obtain the information necessary and pushed through the API. It is 100% safe as I've never had a case where a user's banking information was hacked/compromised from using QuickBooks Online or QuickBooks Desktop. However, you HAVE to make sure that your banking platform is enabled for QuickBooks/Quicken. Otherwise your bank will view these log-ins as a security threat.

- I have just moved from Quickbooks accounting and I must say am very impressed with slickpie. I like how easy it to access the software and program for all computers. I am glad I found the software as it really makes my accounting much easier and saves me a lot of time. It's 100% free accounting software.

Final Verdict

With its beautifully laid out dashboard and easy to use features, QuickBooks is a great accounting solution for small businesses. While it does have some strong competition from the likes of FreshBooks and Wave Accounting in certain areas, it is a good all-inclusive accounting solution.

It is very simple to add your company information. The options available for invoices should suit most users. Payroll is available for an additional fee. This is handy for businesses that prefer to have all their finance tools in one place.