Overview

In the race to the top of the accounting software industry, QuickBooks has taken the lead for years, running laps around its competitors — that is, until now. Xero is a cloud-based accounting software based out of New Zealand that has been giving QuickBooks a run for its money since 2006.

Xero is a robust accounting solution with sophisticated accounting features, ample reports, 800+ integrations, and unlimited users. Unlike QuickBooks, Xero also has the mobility and modern UI of cloud-based software. The software has over 2,000,000 users and is the primary accounting solution for over 16,000 accounting firms. The company has recently added a project management feature, which was one of the most significant drawbacks previously.

However, some of Xero’s most recent improvements have come at a steep cost, and there has been an increase in customer complaints. Xero recently increased its prices, and it no longer includes built-in payroll with its plans. The company has also limited expense claims, projects, and multi-currency support to the most expensive plan. Since our last review, Xero’s customer support has also gone downhill.

While the price may rule out the software for small businesses, Xero still has a lot to offer for medium and large businesses or those in need of multiple users. Keep reading to see if Xero is a good fit for your business.

Xero Accounting Software: Features

With these basics in mind, let’s explore the overall features you can expect with the Xero accounting software—regardless of the plan you choose.

- Invoicing: Create and send customized invoices

- Quotes: Create and send personalized quotes and estimates, easily convert them into invoices

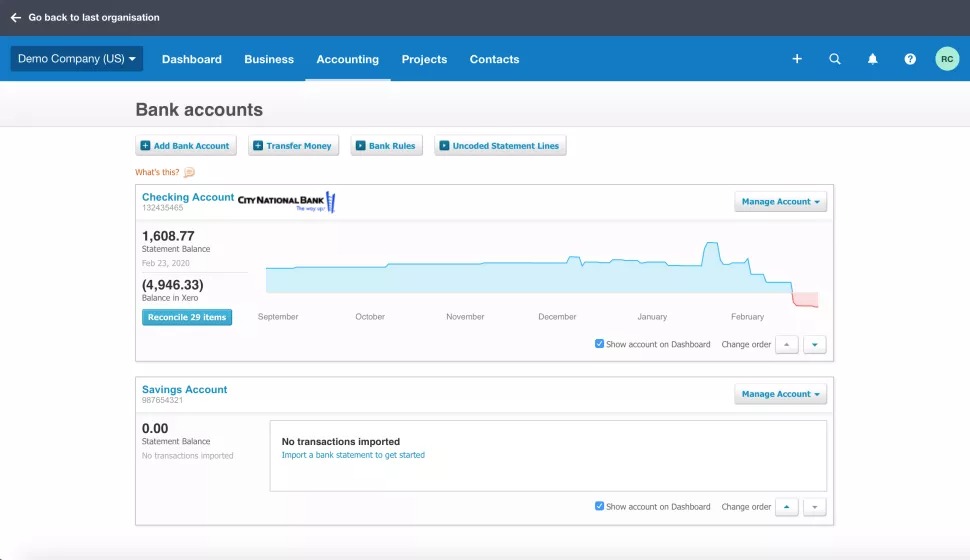

- Bank connections: Connect your bank accounts to Xero to automatically upload transactions into your accounting software

- Bank reconciliation: Reconcile bank transactions, manually categorize transactions, accept Xero’s suggestions, or create rules for matching bank transactions to invoices, bill payments, and purchases already in Xero

- Inventory: Add products, track inventory quantity and value, view bestselling products and how much profit you’re making

- Purchase orders: Create digital purchase orders using inventory items and email them to your suppliers, convert purchase orders to bills or invoices

- Bills: Pay your bills, bundle bill payments, schedule payments for the future, and set up repeat and replicate bills

- Dashboard: Use the customizable Xero accounting dashboard to track bank balances, invoices, and bills, monitor cash flow, view outstanding invoices, and monitor sales and reporting

- Reporting: Create customized financial reports and budgets, track performance, share interactive reports and budgets in real-time

- Files: Store files and transactions within Xero; attach documents to transactions, records, invoices, and contact records; view files side-by-side; share files with team members

- Fixed assets: Record your business assets, update them as necessary, manage depreciation and disposals

- Sales tax: Automatically calculate sales tax rates, customized tax rates for your business needs, set tax defaults, file sales tax returns with Avalara TrustFile integration

- Contacts: Add contacts into Xero, integrate your email account, add contacts to groups and organize based on categories, see a customer’s transaction history—including invoices, bills, most-purchased products or services, and how quickly they pay you

- Payments: Integrate Xero accounting with a payment service like PayPal or Stripe to accept payments for invoices online

- Mobile app: Use free Xero mobile app for Android or iOS to send invoices, approve expenses, input receipts, reconcile transactions, and view customer information while on the go

- Gusto payroll: Add full-service payroll processing to Xero accounting with their partnership with Gusto

- Security: Xero accounting includes encryption, two-step authentication, cloud back-up, and security monitoring to protect your data

- Users: Add an unlimited number of users to your Xero account, customize user permissions

- Integrations: Use the Xero App Marketplace to integrate with third-party tools

- Customer support: Access 24/7 online support from Xero accounting customer service team, utilize Xero’s self-service resources like their video library, blog, and support center

Pricing

Xero used to offer incredibly scalable pricing. The other appeal of the software was that each plan came with unlimited users, access to every Xero feature, and payroll.

As of November 1st, 2018, Xero no longer includes payroll, and it has limited some features (such as expenses and multi-currency support) to its most expensive plan. Each plan still offers unlimited users and live bank feeds, so businesses can download, categorize, and reconcile their transactions as usual.

Xero offers three different pricing plans. Payments are made monthly. There are no annual contracts, so you can cancel your subscription at any time (although you must give a 30-day notice of your cancellation). Xero offers a free 30-day trial and even has a demo company set up already, so you can explore the software before you buy it.

Xero offers discounts for nonprofits and owners of multiple companies. Xero has been known for offering occasional discounts in the past, so be sure to check the company’s website to see if it’s having a sale. Here’s what you get with Xero’s new pricing structure:

Early

Xero’s Early plan costs $9/month and includes:

- Five invoices and quotes

- Enter five bills

- Reconcile 20 transactions

- Live bank feeds

- Reports

- Unlimited users

Growing

Xero’s Growing plan costs $30/month and includes everything in the Early plan, plus:

- Unlimited invoices and quotes

- Manage bills

- Reconcile unlimited bank transactions

Established

Xero’s Established plan costs $60/month and includes everything in the Growing plan, plus:

- Expense claims

- Project management

- Multi-currency support